AVBOB Premiums Explained

AVBOB funeral cover premiums are a topic we often get asked about on our website and social media. In most cases we get clients requesting the exact premium structure so they can calculate the premiums on their own. Some people think there is a set fee for everybody that takes out an AVBOB policy. Little be known that AVBOB premiums are actually calculated nearly uniquely for each person on the policy. There are many factors you must consider. On this page, we will have a quick look at how the premium calculations work.

How AVBOB Calculate Premiums

Firstly, AVBOB calculates premiums using the ages of the members. For example, the premiums will be more expensive for a person who is 60, compared to an individual who is 20. Naturally, the risk will increase with your age. As a result, it becomes more expensive to take out funeral cover as you get older. This increase is why we always suggest you take out a policy before you get too old.

Secondly, the amount of cover will also determine how much a plan will cost. Some clients require a policy worth R10 000, where others require up to R50 000. The higher the cover amount, the more it will cost per month. These are just some of the things we need to take into account when it comes to AVBOB premiums.

Relationships

Another crucial factor is the relationships and the number of people you want to cover. For example, it’s less expensive to include your spouse than what it is to add your parents. There are different brackets for each person you want to cover depending on their relationship with the main member. Each person will also have their cover amount. This allows you to chop and change the premium until it fits your pocket. For example, your spouse can have more cover than your uncle. As you can see, AVBOB premiums are not as straightforward as you might think. Unique premium calculations are an industry standard for any great policy. As you may be aware, Funeral cover does not have any underwriting. What this means is you do not have to go for any medical examinations, or answer any medical related questions to join. The best way providers can make sure they calculate premiums correctly are to factor in all variables.

Fixed Policy Options

Lastly, some policies have a fixed price. In most cases, this is usually a minimal policy that will not cover you for a significant amount. In short, this is almost a “prepaid” option. For example, some prepaid policies will not allow you to add additional members. It’s cover for the main life only and usually for members older than 84 years. Funeral cover providers do not deliberately try and make calculating premiums difficult. It’s all basic calculations. However, if you do not get some help, it might be a tough task. Complicated calculations are one of the reasons why we do not usually do funeral cover quotes over our social media services. We want to make sure we are as efficient as possible. It is important to note that when we assist with premium calculations, we also explain and justify the costs. You have to compare apples with apples. If you allow us to explain the benefits, the cost will make more sense.

AVBOB Premiums Example

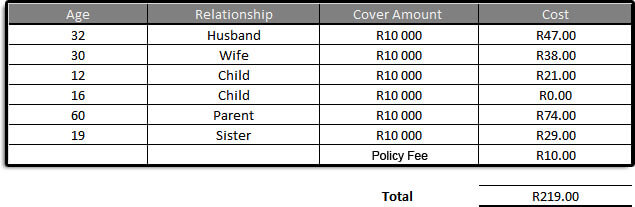

Let’s look at an example of how we calculate the premiums. It’s a medium sized family with some extended member it will look a little something like this.

The Husband is the applicant of the funeral plan, and each member will get R10 000. You will notice that you only pay for one child. Also notice that the premium amount is not the same for all the members, even though the cover amount is the same.

Conclusion

As you may notice, AVBOB premiums are not the same for each person. They all have R10 000 cover, however, the premium changes. You might also see the second child is free. Above is just a simple example of the premium tables. We understand AVBOB premiums and how they calculate the cost. This understanding is one of the main reasons why we do not have a premium table on our website. Our consultants deal with this every day. They know how to structure a policy to get the best out of it.

To get your free AVBOB quote, please complete a basic contact form. We will phone you as soon as we can. We will explain everything to you in great detail. Go Back Home

If you need Group Funeral Cover, Click Here

7 Responses

Valerie De Bruyn

is there exclusions , from when are you covered?

Stanford

I want to join avbob funeral cover with my son I’m 57 yrs and my son is 9 yrs

malerothodi anna maseloa

I am willing to get a funeral cover though I have plenty of questions I am a last born with no children again

sibongo

quote for 20 to 30 thousand cover

Louise

I would like funeral policy policy

And do u guts have life insurance packages

Please calle back

061 ***

Thx

Louise foster

Ndoki Violet Nthako

I request to change the date of the debit order from the last day of the month to the 20th of every month for

all the policies paid by me. ID no. 610607 **** 082

Ntembeko

I would like to get a 1